How does inflation affect Foreign Investments?

You must be familiar with this term called Foreign direct Investment and then there is another term called Foreign Indirect Investment. So together these two terms form Foreign investments. Let’s get to know the difference between direct and indirect foreign investments.

Foreign direct Investment (FDI):-

Foreign direct Investment (FDI) are the physical investments and purchases made by a company in a foreign country, typically by opening plants and buying buildings, machines, factories and other equipment in a foreign country. These types of investments are generally considered long-term investments and they help boost the foreign country’s economy.

Foreign Indirect Investments (FII):-

Foreign Indirect Investments (FII) involve corporations, financial institutions and private investors buying stakes or positions in foreign companies that trade on a foreign stock exchange. So this form of foreign investment is less favorable, as the domestic company can easily sell off their investment very quickly, sometimes within days of the purchase.

In this article, we will see how inflation affect Foreign investments of a nation.

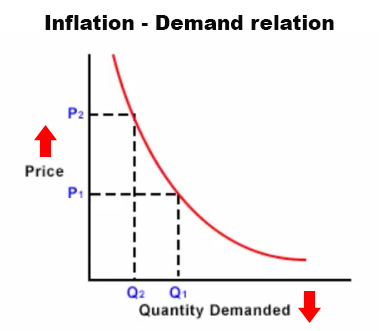

Relation between Inflation and Demand

As i have told you what foreign investments are, now let’s also get to know what is inflation. So inflation means increase in the general price level of goods and services in an economy over a period of time. So when price level increases, people tend to buy fewer goods and services, hence we can also say that inflation reflects a reduction in the purchasing power per unit of money. Now opposite of inflation is deflation i.e. a decrease in the general price level of goods and services.

Measuring inflation

We measure inflation in terms of inflation rate, so anything above 0% is the inflation rate and anything below 0% or negative percentage denotes deflation rate. If at all you are thinking deflation rate is good? No, it is not. Deflation is a problem in a modern economy because it may increase the real value of debt, it will cause recession.

On the other hand, high rates of inflation are caused by an excessive increase in the money supply. In simple terms if people have more money in their hand, they tend to consume more and that eventually increases the prices of goods and services. That is what is the meaning when we say high rates of inflation are caused by an excessive growth of the money supply.

I hope so far you are able to follow up!

Now let’s answer the main question of this article:-

How does inflation affect foreign investments of a nations

You need to understand this, inflation and interest rates are linked. Now you must be wondering “what is interest rates?”. Well, Interest rates or rate of interest is simply the amount that is charged by a lender to a borrower. And easy example would be, when you go to a bank and ask for a loan, you will get it based on certain interest rate. That extra money you pay in the form of interest is called interest rate.

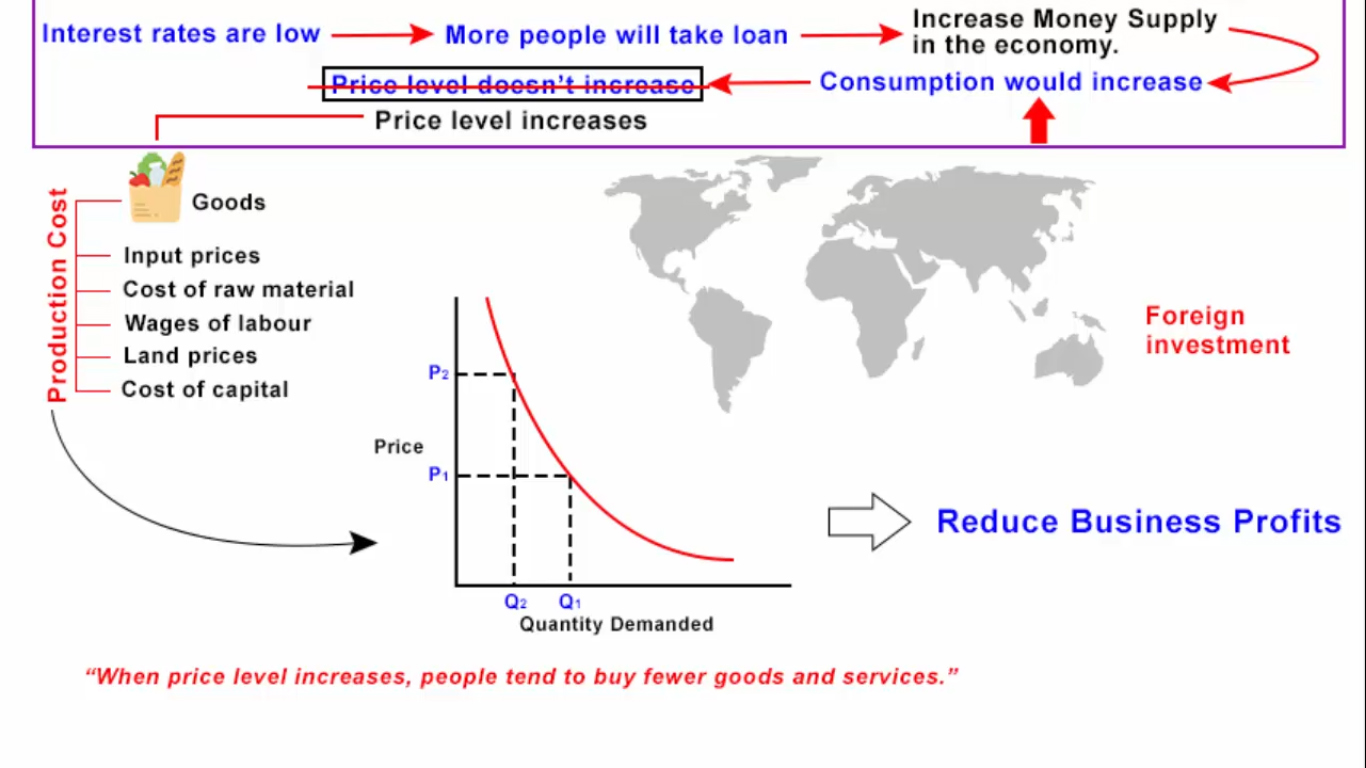

Moments back I said, inflation and interest rates are linked. And the reason i said that is because you see when you go to a bank and ask for a loan, if the interest rates are low then more people will take loan. That increases the money supply in the economy because consumers will have more money to spend. It will grow the economy to grow and prices of commodities will increase which is inflation. I hope you understood how inflation rates and interest rates are linked.

Now i want you to pause and think. An ideal scenario would be:-

Suppose the interest rates are low >>> more people will take loan >>> money supply will increase >>> consumption would increase >>> but the price of commodities do not increase. Let’s say that govt does some trick that holds the price level and rest everything is super good. Just imagine, seeing this foreign investors would be like “wow, people of this country have more money in their hand, inflation rate isn’t high, hence it will be an ideal time to invest in this country”. Now this is an ideal situation, i just wanted to give you something to think.

But in reality what happens is :-

When people have more money in their hand >>> their consumption increases >>> when that happens automatically price of commodities increases (because govt cannot fully control the market) >>> and when the price of the commodities are high >>> that will result in high production cost (because prices of commodities are the sum of input prices, cost of raw material, wages of labor, land prices and cost of capital). All these factors are related to production, hence the cost of all these factors would go up.

Going forward it will affect the demand of domestic commodities as well as foreign commodities. If the price of the commodities are high, then consumer spending will decrease, if domestic products are taking a hit because of this, just imagine foreign products would definitely take a bigger hit. If buying Rice and Dal is getting harder for you, why would you go and eat in McDonald.

All these factors ultimately will lead to the reduction in business profits which in turn reduces foreign investments. After all, the foreign investors will invest in a country if they see high return on their investments. And if the price level of a country is higher enough to cause distress among its citizen, then what good a foreign investor would yield out of that. That’s why you will see government and central bank constantly try to balance interest rates and inflation, but the interrelationship between the two is complex and often difficult to manage. So i hope you understood this correlation between inflation and foreign investments.

I have been following your videos on youtube for a while. What you are doing is not less than a revolution in education.You are gifted with the art of teaching.

Many thanks!!

Thanks Rajat! Appreciate your kind words. 🙂