About the bank

Silicon Valley Bank (SVB) is a commercial bank based in Santa Clara, California, United States. It was founded in 1983 and provides banking and financial services to technology and life science companies, as well as venture capital and private equity firms.

SVB is well-known for its focus on the innovation economy and has become a leading bank for startup companies, offering a range of services such as venture debt, commercial banking, asset management, and investment services. SVB operates in many regions across the globe, including the United States, Europe, and Asia, and has been recognized as one of the most innovative banks in the world.

Role & function of the bank

The role and function of Silicon Valley Bank (SVB) is to provide financial services and support to technology and life science companies, venture capital and private equity firms, and their investors. The bank offers a range of services including:

- Commercial banking: SVB offers checking and savings accounts, credit cards, and lending services to help businesses manage their day-to-day finances.

- Venture debt: SVB provides debt financing to venture-backed companies that need additional capital to fund their growth, without diluting their equity.

- Asset management: SVB provides asset management services for institutional investors and high-net-worth individuals, including investment advisory and wealth management services.

- Investment services: SVB provides a range of investment services, including investment banking, underwriting, and M&A advisory services.

- Global services: SVB helps companies expand internationally by offering cross-border banking, foreign exchange, and trade finance services.

Overall, SVB’s focus is on supporting and fostering innovation and entrepreneurship by providing the financial resources and expertise that businesses need to grow and succeed in the innovation economy.

How did the Silicon valley bank collapse?

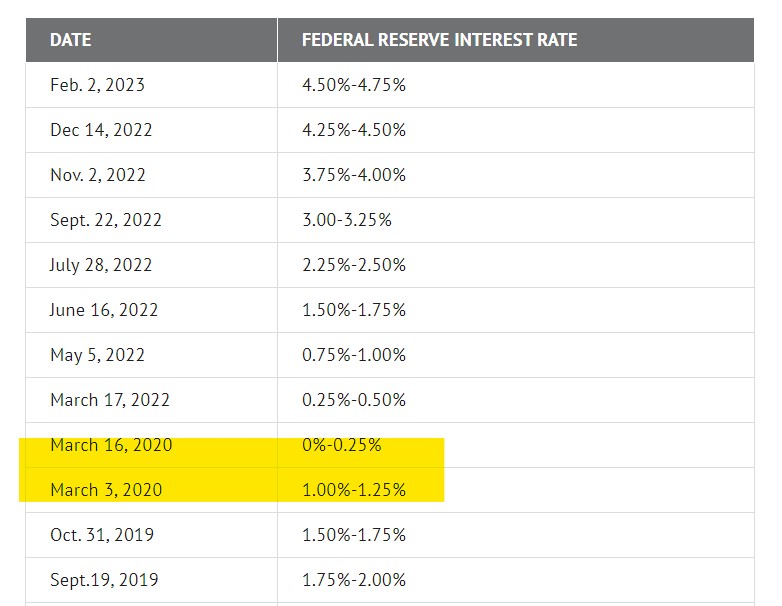

If you remember during the pandemic i.e. in March 2020, the United States federal fund’s interest rates were almost near zero.

In Economics, Zero interest-rate policy is an interesting topic that is part of macroeconomics. What happens is that a country’s Central bank, what they will do is, they will set the interest rate to near zero levels.

It is usually done when there is a period of economic downturn or recession. And the logic behind zero interest rate policy is that borrowing money becomes cheaper. This will encourage businesses and individuals to take loans from banks at a bare minimum interest rate.

Now the whole idea behind this move is to increase the money supply in the market. Which can help stimulate economic activity by encouraging borrowing and spending.

However, there is also a negative effect. When there is more money in circulation it can lead to inflation because when people have more money in hand, then they are willing to pay more, which will eventually increase the prices of commodities. And the second negative effect is, It can also encourage excessive borrowing and lending, which can lead to asset bubbles and financial instability.

Anyhow so during the period of near zero interest rates i.e. in March 2020. The Silicon Valley Bank invested billions of dollars in US Government Bonds.

Now investing in Government Bonds is often considered a safe investment. Although the returns are very low. But then it is considered a safe investment. Simply because the interest rate that you get from investing in government bonds is fixed just like your fixed deposits. When you invest in Government Bonds you are essentially lending money to the government, and in return, they pay you interest over a specific period.

During the pandemic, almost everything was shut down, and we all were locked up at home. There was barely any economic activity going on. And almost every country’s economy badly suffered. Prices of commodities were Skyrocketing. It was almost a recession. So many people lost their jobs. The supply chain was hampered. As a result prices of commodities increased.

Now as usual any Central Bank of any country during a recession what they do is they start reducing the interest rates so that there is some money supply in the market.

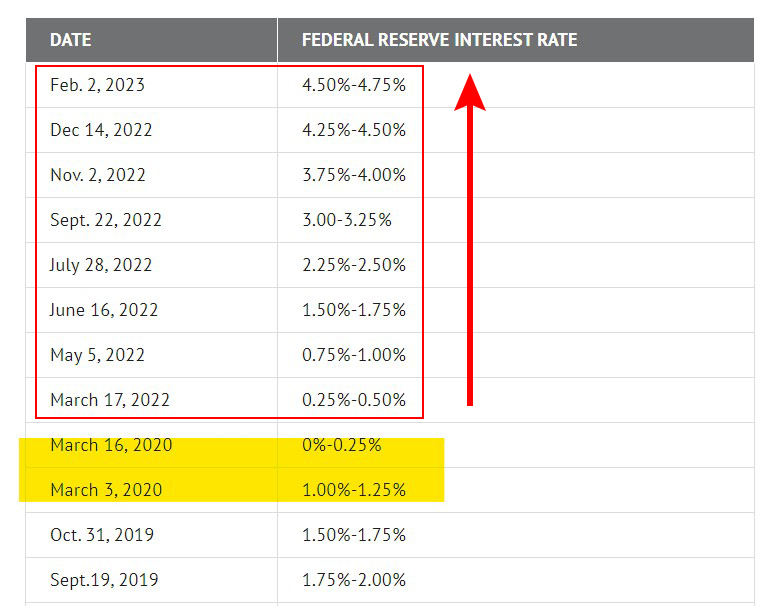

So in 2020 the Federal Bank of United States, they were cutting down the interest rates. And they kept it like that till 2021 end. Suddenly in 2022 beginning, they started increasing the interest rate aggressively.

Now as soon as the Federal Reserve started raising the interest rates to combat inflation. Government Bonds which the Silicon Valley Bank had, their prices started declining. Why? Simply because the new bonds that will be issued by the government, will have newly increased interest rates.

Let me give you an example, suppose you own a bond that pays 2% interest, and interest rates rise to 3%. Suddenly, new bonds being issued pay 3% interest, making them more attractive to investors. Now in a capital market, there are buyers and sellers basically competition. So to compete, the value of your bond must decline, only then the new bond will be attractive as well as profitable for investors.

So this is exactly what happened with Silicon Valley Bank. They invested billions of Dollars in US Government Bonds when the interest rates for near zero. And then suddenly when the US Fed reserve started increasing the interest rates. The value of the Holdings held by the Silicon Valley Bank started declining.

Silicon Valley bank is primarily made up of the Tech companies of the United States. So in reality it was the money of all these tech companies that were invested in the US Government Bonds through this Silicon Valley Bank.

Silicon valley bank is primarily made up of U.S Tech companies. Naturally their investments were declining. To protect their investment these Tech companies were pumping in more money. And at the same time, they were having difficulty raising new capital.

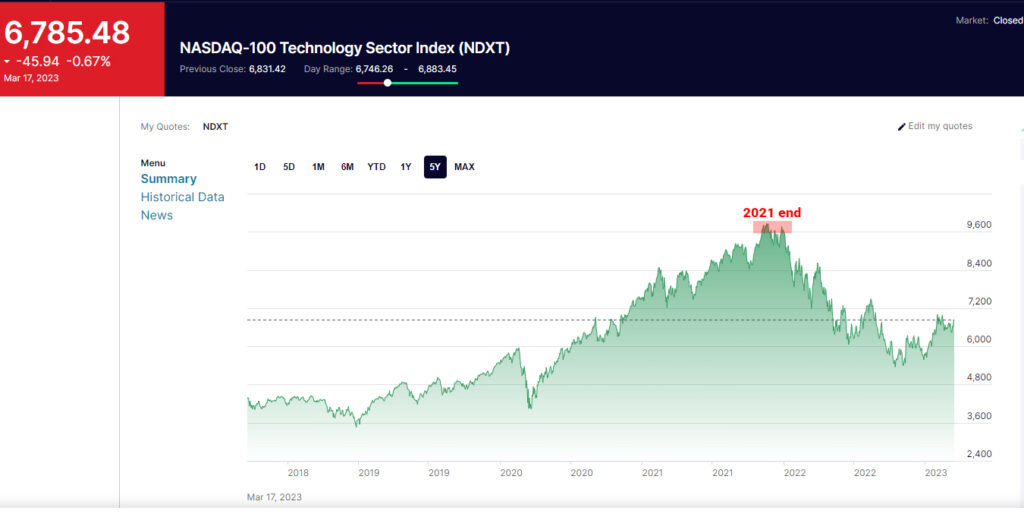

That is why you will see that all the technology stocks were falling since 2021 in the United States. It is also the main reason why we were seeing so many layoffs.

It is all a Domino effect. Now when the technology stocks started falling, that led to panic selling. Many customers who had Technology stocks, sold them, many booked profit, and many had stop losses set, so overall panic selling leads to the withdrawal of enormous sums of money.

If individuals and organizations go into panic selling mode, and they sell their favorite technology stocks. Where do you think the technology companies will raise capital to run their operations? Naturally, they will be forced to withdraw their deposits with the Silicon Valley Bank.

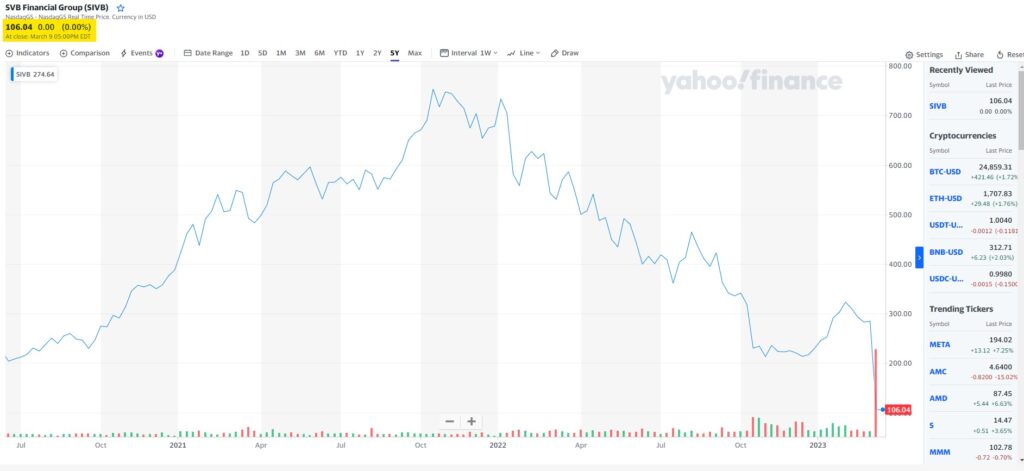

As a result, last week i.e. on Friday, March 10th. Trading in Silicon Valley Bank shares was seized. And the bank has also given up all efforts to raise funds or find any buyer.

Now the government has stepped in. The bank is practically closed, and it has been placed under Federal Deposit Insurance Corporation (FDIC).

They take over the control of the bank’s assets and operations. And their ultimate goal is to sell or liquidate the bank’s assets to pay off its creditors and depositors.

Now, there is a lesson for everyone.

In today’s digital age. When almost everybody has started investing in the capital market, share market, or stock market which is subjected to market risk. But the sole reason behind investing in the capital market is because of its potential huge return and making quick money in a short span of time. In simple words GREED.

You know Greed and Fear are the two main components of the financial market. And Risk is the third component that makes you forget fear and greed.

All these new-age financial advisors motivate you by using the word risk in such a positive manner. But then this is a lesson for everyone. In today’s digital age, every Bank where we keep our hard-earned money invests in financial markets.

When we see a bank like Silicon Valley Bank, run like this, it can cause even a healthy bank to go bankrupt in a matter of days.

In India, if a bank goes bankrupt. Under The Deposit Insurance and Credit Guarantee Corporation Act, 1961′ (DICGC Act) every depositor in a bank is ensured up to a maximum of rupees 5 lakh. Now, please don’t think that if you have 1 lakh rupees in your bank you will get 5 lakhs. No, 5 lakhs is the maximum. I am not discouraging anyone to not put all of their money in banks. You must understand the Law in case of a crisis.

Even in our Hindu religious texts such as Mahabharata, there are many messages that one should never do gambling. Pandav’s had to stay in exile for 12 years and 1 year of concealment because of gambling.

Even the stock market and the share market are a form of gambling. Many of you will not agree with me, and then there are many financial Advisors in today’s time who don’t see that way. But then in the stock market, you make a profit on somebody else’s loss. What do buyers and sellers mean? You will make a profit only when you sell and to sell there has to be a buyer.

But then our whole education system, as well as the government has done a great job in giving a nice legal makeover to the stock market, they have used a much nicer word which is called Investing. And, investing is not gambling.

Likewise, we also have to understand the importance as well as the desperation to raise money for the economy to carry on. And, financial markets are the best place to raise money legally.

So this is the entire story of the Silicon Valley Bank.